Introduction

Decision-making in business involves assessing different options, weighing their pros and cons, and selecting the best course of action. However, without a clearly defined context, decision-makers may face challenges in understanding the relevant factors and interpreting information accurately. Here’s why context is critical for effective decision-making.

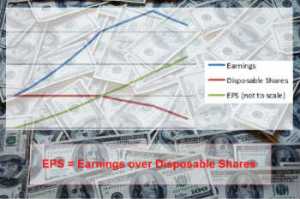

Example: Earning per Share

Earnings per share (EPS) is commonly regarded as a crucial indicator when evaluating a share’s value. It is a straightforward calculation: total earnings divided by the number of shares issued. Generally, an increase in EPS signifies earnings growth and reflects a fundamentally strong business. However, relying solely on EPS may not always provide a meaningful measure of value.

Contextual Considerations:

Assessing the health of a business solely based on EPS can be misleading, as different contexts can significantly impact its interpretation.

Consider three hypothetical businesses, each meeting the EPS growth target of 15% per annum:

Business 1 achieved this growth by increasing earnings through higher sales of core products, indicating a solid business trajectory.

Business 2 may also show increased earnings, but this growth stems from the decision to close down a key production facility and sell assets. While this exceptional earning allows them to meet EPS targets, it comes at the expense of future profits, as they have compromised their ability to meet projected demand.

Business 3 may have artificially inflated EPS growth through share buybacks. While this strategy can provide value to shareholders, especially if the shares are undervalued, it does not substitute genuine growth and cannot be sustained indefinitely.

The IBM Example:

EPS figures can be manipulated to showcase growth even when earnings remain static or decline. An example of financial engineering is demonstrated through IBM’s strategy of share buybacks. Over the past decade, IBM has focused on reducing the number of shares available rather than increasing earnings at the required rates. As a result, EPS has shown consistent growth, which does not necessarily indicate underlying revenue growth. This approach has drawn criticism from analysts who question whether the strategy of inflating EPS through share buybacks truly reflects the company’s ability to generate sustainable earnings growth.

The Role of Data Governance:

Data governance plays a vital role in creating the necessary context for accurate reporting and decision-making. Without proper context, results become subject to misinterpretation. EPS is just one example of a metric that can be viewed differently depending on the context applied. Varied interpretations of metrics across different business units or managers, sourced data from disparate systems, and inconsistent calculations can lead to confusion and conflicting results.

Ensuring Trustworthy Results:

To build trust in the data and prevent costly failures in business intelligence (BI) or enterprise data warehouse (EDW) projects, context must be provided for each report and calculation.

This includes understanding how any metric was calculated, identifying data sources and assessing underlying data quality, specifying the measurement period, mapping results across systems, geographies, and business units, and ensuring consistency in key metrics.

Context is Key:

Having context for data is essential in making informed decisions and conducting due diligence. Capturing context can be achieved through a business glossary, documenting business data lineage, and establishing connections between business definitions and technical metadata. Context allows decision-makers to understand the story behind the data, giving them the additional data necessary for an informed decision.

Conclusion

Without context, EPS alone is an insufficient indicator of a company’s value. Relying solely on this, or any other metric, can be misleading without considering the contextual factors that influence its interpretation.

Data governance is crucial in providing the necessary context to any metric, fostering accurate reporting, and supporting data-driven decision-making. By understanding the limitations of your metrics and embracing comprehensive data governance practices, businesses can derive meaningful insights and improve overall value assessment.

Leave a comment