Master data management (MDM) and a single view of data (SVD) are often used synonymously, but they are not the same. MDM creates a single, authoritative record for each core entity within an organisation, like customers, products or locations. In contrast, a single view adds additional context for each of these entities, for example by adding behavioural and transactional data. Without accurate master data, any single view suffers from data quality issues such as duplicates that reduce its value.

- MDM vs. SVC: Partners in Customer Understanding

- MDM’s Role in Building the SVC:

- The Value of a Single View:

- Conclusion:

Let’s dive into the key differences, leveraging the customer as an example, highlighting how MDM empowers the creation of a single view and why it’s so valuable.

MDM vs. SVC: Partners in Customer Understanding

- MDM: A technology and process that ensures consistency, accuracy, and completeness of core business data across the enterprise. It focuses on “mastering” data like customer names, addresses, product information, and vendor details.

- SVC: A unified representation of a customer, aggregating data from various sources and presenting it for analytics. It extends master data, encompassing insights, behaviours, and interactions to truly understand the customer.

MDM’s Role in Building the SVC:

- Data Cleansing and Standardization: MDM removes duplicates, inconsistencies, and errors from customer data, creating a reliable foundation for the SVC.

- Data Governance: MDM establishes rules and processes for managing and accessing customer data, ensuring its integrity and security within the SVC.

- Data Integration: MDM bridges the gap between disparate customer data sources, making it accessible for building the SVC.

MDM is not the SVC, but it’s the critical first step. Think of it as building the foundation of a house: you need strong, solid walls before you can decorate and personalize it for each occupant. Similarly, MDM creates a clean and consistent data foundation, but it’s up to other tools and processes to layer on insights, interactions, and context to create a truly meaningful SVC.

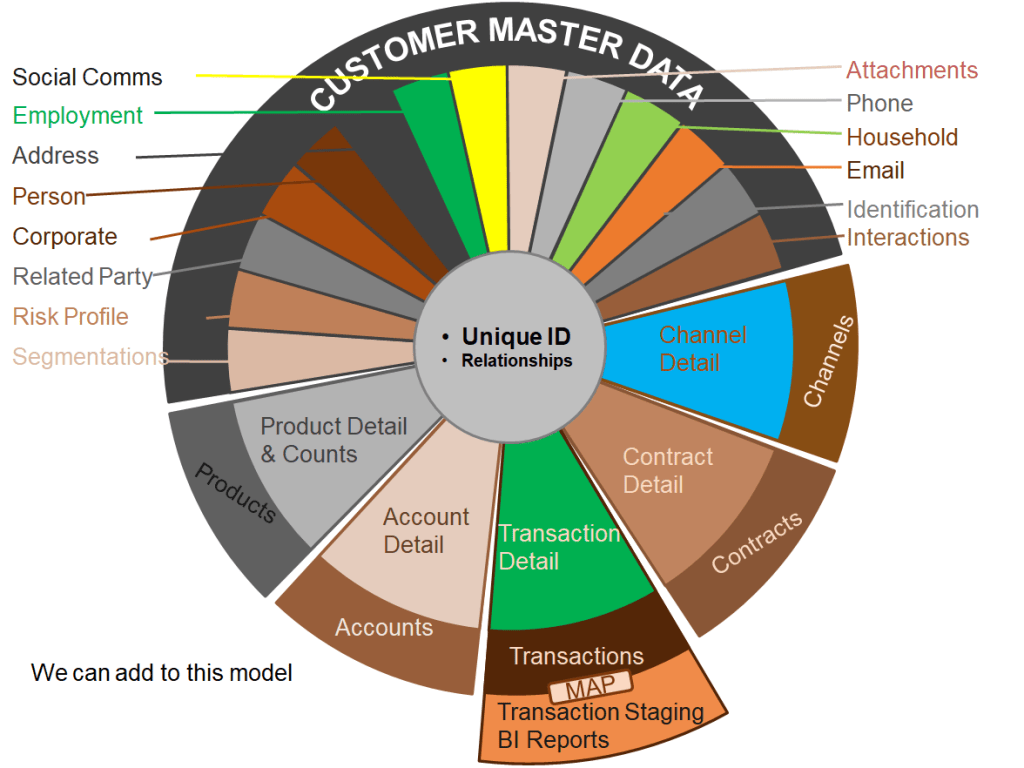

The conceptual model illustrated below shows an extended customer master and single customer view that we built for a large bank. In this case, the primary business goals were to extend share of wallet i.e. to identify opportunities to add additional financial services products to each customer’s portfolio. This could only be achieved by first consolidating and connecting related customer records from the core banking and product processing applications ( a master data problem) and then adding related data.

The Value of a Single View:

The benefits of a single view of the customer are substantial and backed by research:

- Increased Revenue: McKinsey & Company reports that companies with a strong omnichannel customer experience strategy, enabled by a single view, achieve up to 10% higher revenue growth.

- Improved Customer Satisfaction: A Salesforce study found that 84% of customers say that a consistent experience across channels is very important to them.

- Enhanced Operational Efficiency: A Forrester report estimates that a single view can reduce marketing spend by 15% and operational costs by 20%.

- Ensuring Data Privacy: A SCV acts as a powerful tool for PoPIA compliance, by centralising and mapping personal data and permissions, simplifying data governance and security, and facilitating breach identification, impact assessment, and mitigation. SCVs support broader technical and organisational measures crucial for ensuring data privacy.

Conclusion:

While MDM and SVC are often used interchangeably, it’s crucial to recognize their distinct roles. MDM is the essential building block, ensuring data accuracy and consistency. However, a single view of the customer requires additional layers of analysis, insight, and context to truly understand and engage with customers in a meaningful way. By leveraging both MDM and other relevant tools and strategies, businesses can unlock the true value of customer data and build lasting relationships with their customers.

Leave a comment