Few industries have faced up to the challenges that Telecoms do.

While there are specific challenges related to specific geographic markets, a global review of industry challenges looks pretty much the same from any perspective.

Challenges in Global Telecomms Markets

The market is changing, and these changes are impacting operators. The primary changes that have occurred in the last decade can be summarised as (Market Research, CMO Council, 2013):

1. Low competition on price > Aggressive price competition

Whereas previously there was very little competition on price, the proliferation of service providers has led to aggressive price competition, which has had an impact on customer experiences.

2. Innovation led by operators > Innovation led by devices & media vendors

Previously, operators were able to control the rate of change to services simply because they drove innovation. Today the picture is vastly different, with handset providers, third-party application developers and others who are driving the development of services over the network. This reduces the effectiveness of new revenue generation opportunities for operators.

3. Operators walled garden > Power to end users ( regulation, over-the-top content )

Related to this is the effect of partner-led innovation on operator’s walled gardens. Regulation has pushed considerably more power to the end user and now partner organisations, as opposed to operators, control walled gardens. In addition, OTT content is streamed via the network without providing any additional revenue opportunities for Telecoms.

4. Voice > Data

The nature of the innovation and the services they offer is not generally in the field of voice telephony. Rather Telecoms are under increasing pressure to carry data in ever larger volumes at higher speeds. Again the role that a Telecom plays in this is merely as a conduit for high-value services provided by others and opportunities for revenues are squeezed.

Is Big Data the answer?

Facing up to just these telecommunications market changes is difficult enough – but there is more.

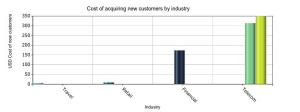

High Customer Acquisition costs

Telecom customer acquisition costs are high.

Telecom customer acquisition costs are high.

On average the industry spends 50 x more on acquiring a customer than the travel industry, 35 x more than online retail and 2 x that of the financial services industry. With costs like that, you cannot afford to lose customers. Given the cost of acquiring new customers, it’s clear that customer churn is a threat to profitability. (Pitney Bowes, 2013)

Churn is a real threat to Profitability

Understanding why customers churn is not difficult.

It’s simple. It’s as common a theme in popular sub-culture as it is in the boardroom.

Customers churn because of poor customer experiences and poor service and a perceived lack of innovation and value.

For every customer complaint a Telecom receives, on average there are 26 other silently unhappy customers

Lee Resources, 2014

The vast majority of these will never complain, they will simply churn.

Reducing churn rates massively increases profitability

Based on this, it is possible to do some helicopter Fermi estimation and come up with a figure that when multiplied by the number of complaints you receive in a given time period gives you an understanding of the dollar value of the risk of churn that you are exposed to.

Every complaint is backed by 26 potential churners, which makes 27 candidates.

Given that the rate of silent churn is around 90% for this group of customers (1Financial Training Services), we are left with just over 24 churn candidates at a replacement cost of between $315 and $350 (Pitney Bowes) a piece.

And because these customers will not complain it is difficult to make amends for poor service simply because you don’t know who they are.

Predicting who they are is not possible without Big Data.

For every complaint, we are exposed to a theoretical churn risk of between $7654 and $8505, expressed in customer replacement cost dollars.

For every complaint, #telcoes face a potential #churn risk of $8000. #BigData helps to identify which customers are at risk of churn, increasing profitability by up to 95%

Tweet

The prize for doing something to prevent this churn is a big one. Reducing customer defection rates by just 5% can increase profitability by between 5 and 95% (Bain and Company, 2014).

The Big Data opportunity

Big Data Analytics capabilities enable Telecoms to create a complete picture of customers, across all channels, both those within your organisation and those that it does not. Location data, Social channels, campaigns, web and transactional data, including sentiment analysis, and voice data all represent important sources of information that can be combined to create a complete view of the customer across all channels. This in turn leads to opportunities to intervene and prevent churn.

Big data allows Telecom organisations to easily combine massive datasets, very rapidly, thereby enabling insight far more cheaply and effectively than before, by using commodity hardware and big data tooling.

Churn, and other analytics models, can now be run against years, or even decades, of call data records rather than against the few months stored in the enterprise data warehouse. Structured and unstructured data sets, such as CRM interactions, web logs or even social media can enhance the client view giving an unparalleled insight into customer demographics and behaviour.

Simplified data management

Gone is the need to design a schema, crunch all the data into a schema and then analyse the schema and many of the associated costs. Big data means that Telecom organisations are able to achieve insight in days, as opposed to weeks or even months, at a significantly reduced cost.

An enriched, cross-channel, customer-experience-led, customer view also provides insight into those portions of the customer journey which are most likely to generate churn. Utilising various analysis techniques to profile and segment customers, detect patterns, find hidden relationships, determine frequencies and predict next steps, global Telecoms are able not only to effectively reduce churn, but also to address the issues that lead to customer churn – poor customer experience.

Other Analytics Opportunities

To be clear there are opportunities too, that go beyond staunching churn.

Telecoms firms can provide real value to their customers, that is relevant and that dis-intermediates OTT service providers. As an example, telecoms firms that provide data services are in a prime position to measure the amount of malware that is active on their network. They are likely to be the first to be able to detect known malware patterns and identify new ones. It is both in their and their customer’s interests to minimise the impact of malware on their networks.

Some 55% of churning customers would be willing to pay more for a better serviced, more relevant product and service mix from telecoms firms.

Big Data Analytics offers the Telecom industry both opportunities and answers to some of the biggest challenges they face.

Big data offers telecoms as an industry the opportunity to do this and more.

image sourced from http://en.wikipedia.org/wiki/Orange_S.A.

Leave a comment